Compound interest calculator

Make your money work for you. This is how your savings grow with the help of our investment solutions.

Make your money work for you. This is how your savings grow with the help of our investment solutions.

Kay or Jordan are happy to set aside time for a personal chat with you. Independent, non-binding, and on equal terms.

Kay

Jordan

More than 20’000 clients use findependent and have entrusted us with over 400 million francs in assets. The percentage of clients with an investment portfolio of more than 100’000 francs has multiplied in recent months.

Kay

Jordan

Sliders

Your path, your pace. With a few clicks in the compound interest calculator, you can simulate your journey: Start with your desired amount and see how much tailwind a monthly savings plan gives you.

Choose your strategy. We’ve pre-selected “Balanced” for you so you can see right away what’s possible. But you can step it up or slow it down at any time. Choose the investment solution that fits your life.

Visualize your freedom. Drag the timeline into the future and let compound interest work its magic. This way, you see in black and white how small steps turn into real independence over the years.

Calculation basis for savings account

For the savings account, we use an interest rate of 0.25% in our calculator. Sure, some banks lure you with slightly higher rates for a short time. But look closely: these offers often only apply for a limited period or up to a certain amount. We prefer to stick to a realistic view so you know where you stand. Because true financial freedom needs a solid foundation instead of bait-and-switch offers.

Calculation basis for investment solution

The magic of your endurance

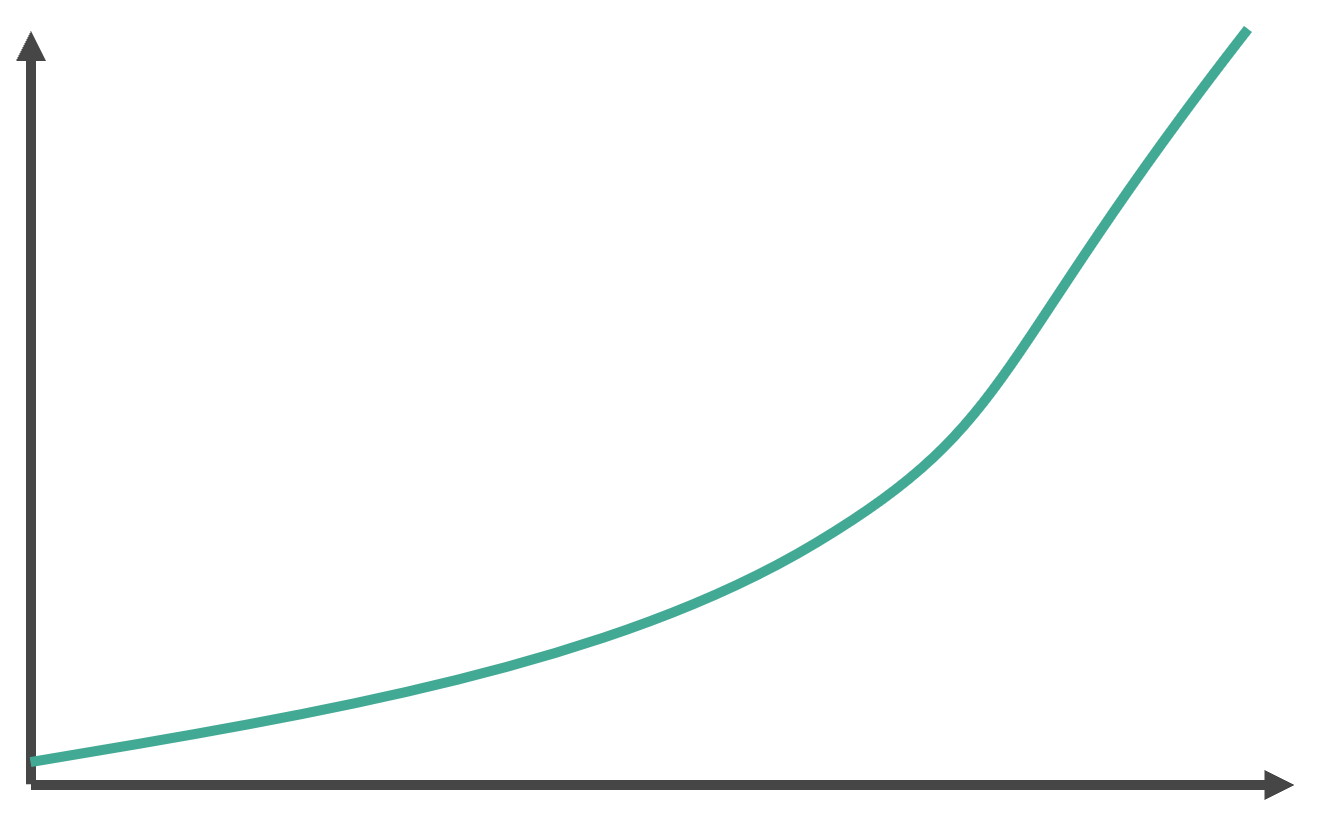

With our calculator, you discover the potential of your money. Your advantage grows with every factor: how much you invest at the start, how regularly you add to it, and how much time you give your assets to work. Something fascinating happens: your money doesn’t just grow steadily step by step. Thanks to compound interest effect, your journey gains momentum – the longer you stay on board, the steeper the curve points upward. Small, regular contributions thus turn into a considerable sum for your financial freedom over time. Time is your most valuable ally here.

Which functions are you missing? What would you like to see improved in our yield calculator? Let us know: hello@findependent.ch.

Your money in the savings account is sleeping – and quite deeply, unfortunately. When you choose an investment solution, you wake it up. This way, you make significantly more from your savings in the long term and use compound interest as your strongest ally on the path to more financial freedom. You now have the numbers in black and white – time to put them into action. In the video, Kay shows you with a concrete example why the right time to start is exactly now.

The video is in lovely Swiss German. However, you can enable English subtitles.

Compound interest is, as the name suggests, interest that accrues on your existing interest. If you reinvest the interest from your investment, you will earn interest on it again. The longer you reinvest your earnings, the more you benefit from this effect, the so-called compound interest effect.

A side note: By interest here we mean the return. That is why it should correctly be called “returns” and not “compound interest”. The compound interest calculator would then be called yield calculator. However, the term compound interest has definitely become established.

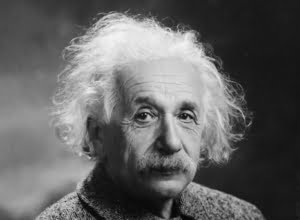

Albert Einstein commented on compound interest at the beginning of the 20th century. There are various quotes attributed to him.

“Compound interest is the eighth wonder of the world. Whoever understands it earns from it, everyone else pays for it”

Einstein is also said to have said that the “greatest invention of human thought is compound interest”.

Albert Einstein, 1879-1955

Risk

Financial markets fluctuate and no one can predict exactly how they will change. Therefore, even with findependent’s compound interest calculator, there is no guarantee that your investment will actually develop in this way. We make assumptions when calculating returns, which are of course not universally valid. However, they are based on actual, historical values.

Fees

Investing money is always associated with certain costs. In addition to product costs and external transaction costs, there are usually fees for administration and custody account management.

Just like your interest rates, the level of your fees also plays a major role. The lower the fees of your investment solution, the more of your savings will be left for you.

Fee-free amount & fees for findependent

With findependent you benefit from paying no management and custody fees up to an amount of 2’000 francs, for life.

On your investment sum above 2’000 francs you pay 0.40% per year. From 50,000 francs, we have also introduced a sliding scale, with fees gradually decreasing down to 0.29%. You can find the exact scale in the fee overview.

Further details on costs and our fee calculator can be found here.

How much money after 10 years of ETF savings plan?

That depends primarily on the chosen investment strategy and the level of fees. With findependent’s pure risk-averse equity strategy, the final value after 10 years is around CHF 84,000 (with a starting amount of CHF 2,000 and a monthly deposit of CHF 500)

How much money in the account is normal?

You should always have enough money in your account to pay your running costs. In addition, 3 to 6 months’ wages have proven to be an appropriate nest egg. However, the exact amount depends heavily on your own standard of living and the amount of your salary.

What is the maximum amount of money you should have in your account?

That depends very much on what purchases you have planned. Money that you will need in the next 3 years should be left in your savings account despite low/no interest rates. Savings that you won’t need for at least 3 years can be invested.

Compound interest is, as the name suggests, interest that accrues on your existing interest. If you reinvest the interest on your investment, you will earn interest on it again. The longer you reinvest your earnings, the more you benefit from this effect, the so-called compound interest effect.

Another side note: By interest we mean the return.