We are a FINMA-licensed securities firm, meaning your account and assets are held directly with us at findependent.

We are now your securities firm!

- More speed: Deposits show up in your app even faster

- More choice: Look forward to a Pillar 3a (in the second half of 2026)

- Full security: FINMA-licensed and as secure as a bank

Use code START

Only until 15 March 2026

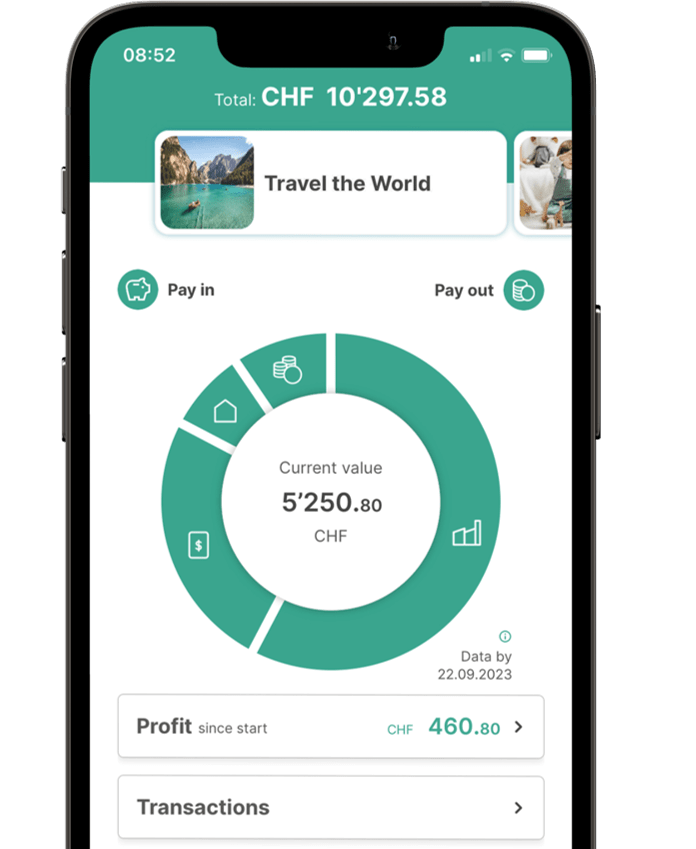

Relaxed investing

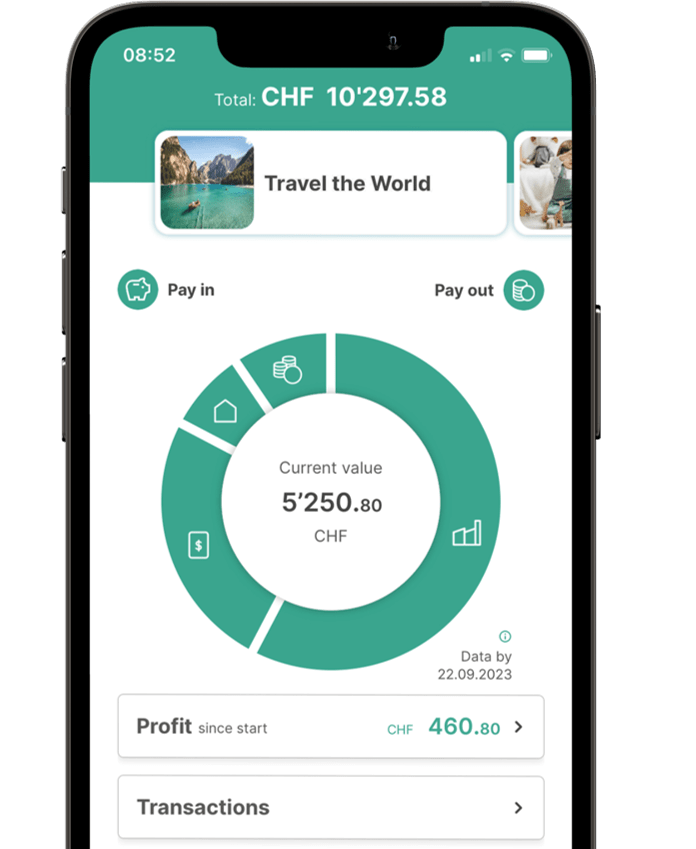

Pick one of our 5 sustainable investment solutions or build your own custom ETF investment solution.

You’re in the driver’s seat, with total flexibility over when and how much you deposit.

Leave the heavy lifting to us: we’ll invest your money automatically and monitor the financial markets around the clock for you.

Relaxed investing

Pick one of our 5 sustainable investment solutions or build your own custom ETF investment solution.

You’re in the driver’s seat, with total flexibility over when and how much you deposit.

Leave the heavy lifting to us: we’ll invest your money automatically and monitor the financial markets around the clock for you.

Cost-effective digital investment app

Thanks to our very low management and custody fees, the vast majority of the returns stay with you.

Plus, you pay no transaction fees (brokerage fees) and your first 2’000 francs are permanently free of charge.

Cost-effective digital investment app

Thanks to our very low management and custody fees, the vast majority of the returns stay with you.

Plus, you pay no transaction fees (brokerage fees) and your first 2’000 francs are permanently free of charge.

App with heart and soul

We are an established team of experts and provide you with fast support and advice at eye level.

The renowned Prof Dr Thorsten Hens from the University of Zurich strengthens our investment committee.

Independent doesn’t mean alone: Book an online call with Jordan or Kay.

App with heart and soul

We are an established team of experts and provide you with fast support and advice at eye level.

The renowned Prof Dr Thorsten Hens from the University of Zurich strengthens our investment committee.

Independent doesn’t mean alone: Book an online call with Jordan or Kay.

Scan the QR code, get the app, and start your journey to greater financial independence.

How your money works for you

Our returns calculator shows you how much faster you’ll reach financial independence with findependent.

Security you can count on

We’re much more than just a cheap investment app

Because financial independence starts with a great feeling

Total peace-of-mind package

Convenient investing with fair fees.

Experienced Team

Fast, personal contact

on an equal footing.

Intuitive app

Simple language instead of

financial jargon, all in one place.

![]()

Get started digitally – all set in just 10 minutes. Zero paperwork, zero bank visits.

![]() Forget the fees – we’ll manage your first 2’000 francs for free to get you off to a flying start.

Forget the fees – we’ll manage your first 2’000 francs for free to get you off to a flying start.

![]() Grow more, pay less –as your assets grow (from 50’000 francs), you’ll automatically benefit from lower fees.

Grow more, pay less –as your assets grow (from 50’000 francs), you’ll automatically benefit from lower fees.

![]() Zero hidden fees –we don’t charge for deposits or withdrawals, and your electronic tax statement is included for free

Zero hidden fees –we don’t charge for deposits or withdrawals, and your electronic tax statement is included for free

![]() Total freedom –no lock-in periods, no hidden fees. We build on trust, not fine print.

Total freedom –no lock-in periods, no hidden fees. We build on trust, not fine print.

![]() Ready in 10 minutes – Digital with zero paperwork.

Ready in 10 minutes – Digital with zero paperwork.

![]() Fees on us – We’ll manage your first 2’000 francs completely fee-free.

Fees on us – We’ll manage your first 2’000 francs completely fee-free.

![]() Grow & benefit – Enjoy reduced fees on investments of 50’000 francs or more.

Grow & benefit – Enjoy reduced fees on investments of 50’000 francs or more.

![]() No extra cost – Free deposits, withdrawals & annual tax statement.

No extra cost – Free deposits, withdrawals & annual tax statement.

![]() Total freedom – No lock-in periods

Total freedom – No lock-in periods

Hop on board

FAQs – frequently asked questions and answers about findependent

FAQs

How many clients does findependent have?

findependent has more than 20,000 clients who use our investment app and actively invest money with us.

How does findependent earn money?

You pay us an asset management fee (0.20%), which together with the custody account fee amounts to 0.40% (or less, for investment sums of CHF 50,000 or more). The fee is calculated on the value of your investment solution at the end of each quarter and debited directly to your findependent account.

Is findependent safe?

Yes, because findependent is an account-holding securities firm authorised and supervised by the Financial Market Supervisory Authority FINMA. Your ETFs belong to you alone. Even in the unlikely event of findependent’s bankruptcy, they are fully protected as segregated assets. Your cash (1% of your investment solution) is covered by the depositor protection. Your money is as safe as with any bank.

How much interest does findependent pay?

The findependent account only holds 1% of your investment amount, we do not pay interest on this. In the past, the findependent investment solutions returned roughly between 3% and 6% per year (on average over a period of several years and net, i.e. after deduction of all costs).

What to do with the money in your savings account?

With a broad-based and favourable investment solution, you can benefit from long-term economic growth. This allows you to make more of your money and prevents the purchasing power of your savings from falling due to inflation. With a medium risk appetite, you can expect an average annual return of around 5% over a longer-term investment horizon.

How can I invest money without risk?

Nothing happens entirely without risk. Even a savings account harbours risks, in this case in the form of a loss of purchasing power due to inflation. However, if you invest in a broad-based investment solution, you can significantly reduce the fluctuation risks. With a long-term investment period, the probability of success can even rise towards 100%.

What is the best way to become wealthy?

Invest your money instead of letting it sit in your account. Use simple, favourable and transparent investment solutions that invest in a broad range of ETFs.

How much money does a normal person have in their Swiss bank account?

A sensible nest egg is 3 to 6 months’ wages, but this depends heavily on the individual situation (income level, total assets, liabilities, etc.).

What should I invest in?

Invest broadly and make sure that the instruments used are cost-effective. Investment solutions that rely on ETFs have proven their worth. The longer the investment horizon, the higher the proportion of equity ETFs can be. The shorter the investment horizon, the more different asset classes you should hold, such as bond ETFs, property ETFs and precious metal ETFs.